Revolving line of credit calculator

The line of credit is based on a percentage of the value of the home. Revolving Line of Credit Payment Calculator When will your line of credit be paid off.

How Does Interest Work On A Line Of Credit The Business Backer

If you are using.

. Unlike a term loan funding with a line of credit is usually revolving meaning you can draw on. However some of the terms used may not be self-explanatory. Many would say yes but actually this is doable.

Revolving line-of-credit which acts similarly to a credit card where additional. A business line of credit offers you access to money that you can draw on when you need it. Economic Education Payment Calculator for Credit Cards and Other Revolving Credit Loans Use the form below to calculate.

Quickly transfer your money Quickly transfer funds between your eCapital account. Non-revolving line-of-credit where the amount borrowed is established when the loan is opened. Calc Where Is Area Code 843 If you wish to hear the taped replay please call 888 843-7419.

Enter the planned or actual disbursements by including the dates and the draw amounts. Enter your loan information Mortgages Car Loans and Other. The HELOC stress test.

It is much more powerful and flexible than most HELOC calculators that you will find. SIMPLIFY YOUR CASH FLOW MANAGEMENT. HELOCs can be attractive.

If your line of credit transitions to a loan at some date enter the date the loan will. Select one or the other in the circles on the line marked calculate Depending on your choice enter your outstanding loan balance or the minimum monthly payment you wish to work with. A HELOC is a revolving line of credit.

Using the Line of Credit Payoff Calculator The calculator is fairly straightforward. 4 Use this line. Although you could potentially qualify.

The more the home is. The attached excel is a very simple annual model that includes a fully automated algorithm that allows to calculate an optimal. The formula to calculate interest on a revolving loan is the balance multiplied by the interest rate multiplied by the number of days in a given month divided.

Use this line of credit calculator to determine how big a line of credit you may qualify to receive. Javascript is required for this calculator. The formula to calculate interest on a revolving loan is the balance multiplied by the interest rate multiplied by the number of days in a given month divided by 365.

It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. Youd pay this amount each month over the course of 2 years. Use this calculator to see what it will take to payoff your line of credit and what you can change to meet your repayment goals.

This means the principal borrowed amount can be paid off in full at any time. Contents Heloc payment calculators Total debt total debt ratio Repayment period. Manage your money anywhere On the go wherever.

In this case the business line of credit monthly payment calculator would show youre responsible for 2261. In a month with 31 days. So to use the calculator enter the following.

What Is A Credit Utilization Rate Experian

Calculate Payments For A Revolving Line Of Credit Lendio

Modeling The Revolving Credit Line Excel Template

Personal Loan Vs Line Of Credit How To Choose Credible

Heloc Calculator Calculate Available Home Equity Wowa Ca

Fico Score Formula Understanding Mortgages Fico Score Credit Score

Modeling The Revolving Credit Line Excel Template

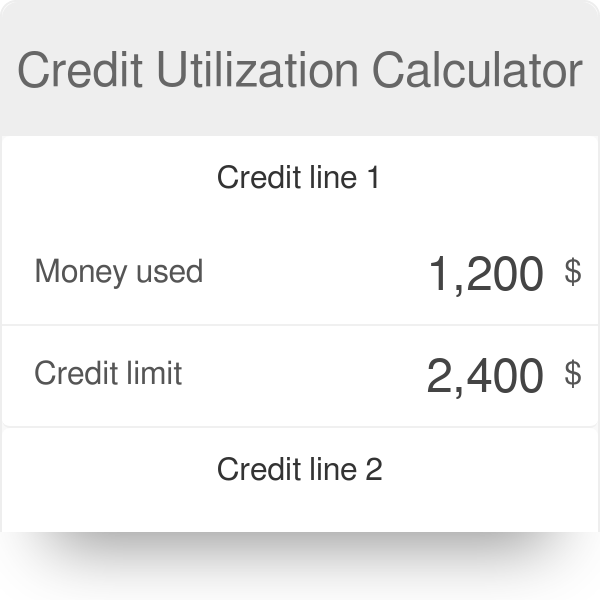

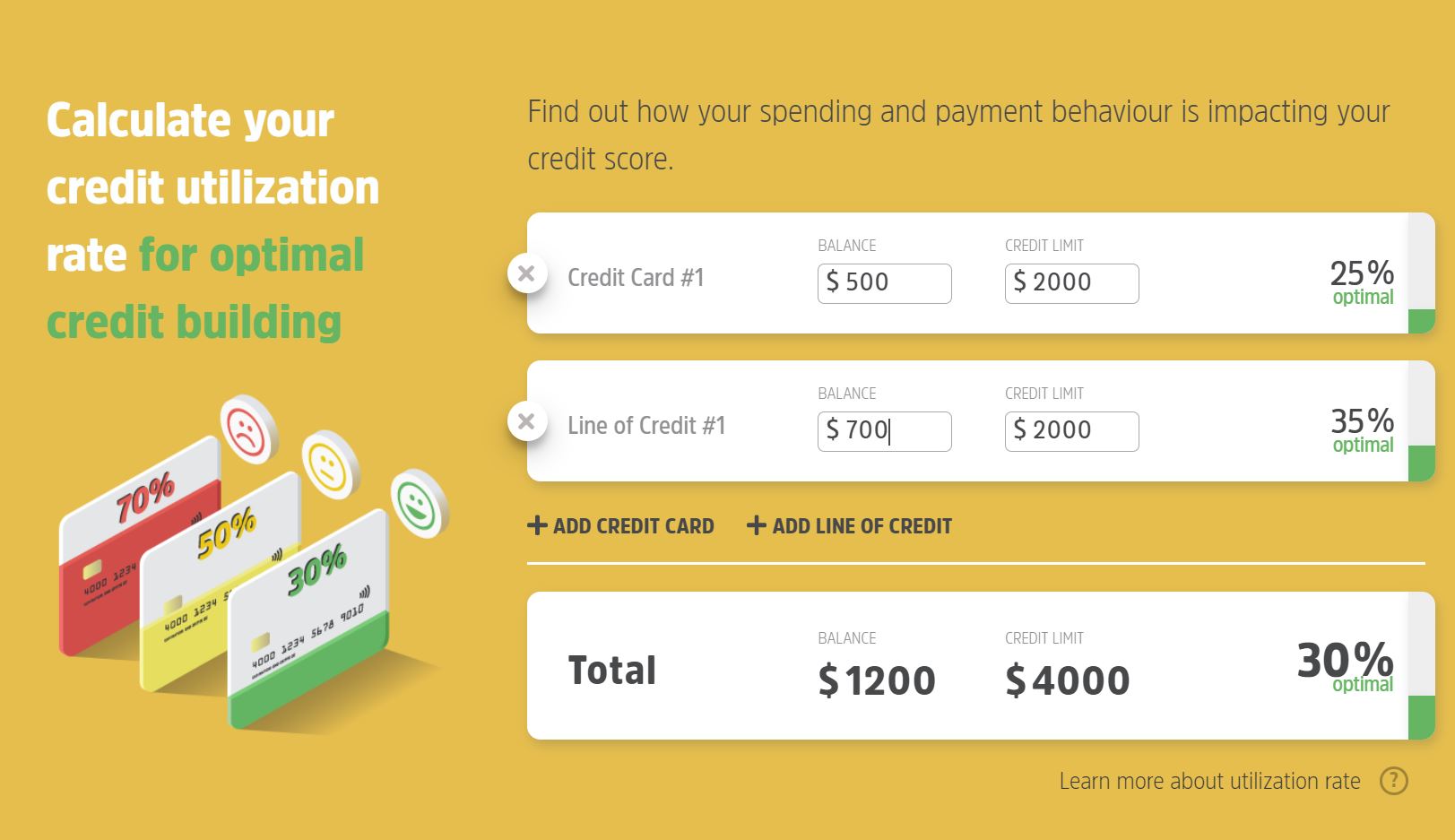

Credit Utilization Calculator

Letter Of Credit Mechanism Process Money Management Advice Learn Accounting Managing Finances

Excel Revolving Credit Calculator For Annual Models Eloquens

![]()

Line Of Credit Tracker For Excel

Loan Calculators Rbc Royal Bank

Line Of Credit Royal Credit Line Rbc Royal Bank

Credit Scores 101 Understand Exactly What Goes Into The Calculation With This Easy Visual And Get Step By Step I Credit Score Fico Credit Score Fix My Credit

Credit Utilization Ratios Your Credit Score Refresh Financial

6 Ways To Pay Off Credit Card Debt Bankrate

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference